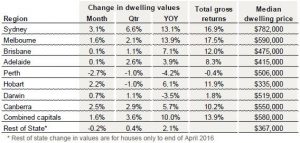

Sydney leading the charge as dwelling values rise in May

Whilst month on month figures are a little haphazard, the last quarter has seen Sydney prices grow by 6.6% with Perth and Hobart the only capitals in negative territory.

Our current property growth cycle comes to around 4 years now since May 2012 and values have risen 36.6% to May 2016. Sydney’s growth for this period stands at 57.5% with Melbourne at 37.4% and Brisbane next in line at 18.5%.

The graphic below shows the combined capital city growth rates for the current cycle.

You can clearly see where values (total returns) rebounded from May 2012 and a bit of a problem for the housing bubble evangelists that surfaced around February this year.

Whist 5 year total returns to May 2016 see Sydney and Melbourne at 85.3% and 51.7% respectively, the growth cycle has matured and we’re more likely to see modest growth over the coming years.

In essence, these RP Data/Core Logic figures are an overview, and local factors such as capital city unit oversupply issues represent spectacular opportunities to post negative returns. We’re strong advocates of seeking the right advice to ensure you’re investing in pockets with strong growth drivers and fundamentals.