Scrapping & Tax Depreciation – Writing off an asset

Previously I’ve written about how effective lives are determined, which gave a quick insight into the process of ‘scrapping’. In simple terms, scrapping is the process of throwing away an asset that has reached the end of its physical life. The benefit from a depreciation perspective is that the remaining written down value of the asset can be claimed at 100%.

Now this all comes with a few rules and disclaimers, and it’s important to understand a few key points.

1. The asset can no longer be used. In ATO speak;

“Once a taxpayer has scrapped or abandoned an asset, there is a presumption it can no longer be used by anyone for the relevant purposes. The scrapping of an asset demonstrates that the asset is either physically exhausted or obsolete. A taxpayer may abandon an asset if it is too difficult or costly to remove it from its place of operation.”

For example, you cannot remove a set of old curtains from one investment property, claim the residual value, and then install them in a new investment property and continue to claim depreciation.

2. In a newly purchased property, there must be an intention to rent the property as is.

To put it another way, the ATO has been quite clear that purchasing an investment property with the intention to renovate it immediately, does not fit their criteria for being eligible for scrapping deductions. If you were to purchase an older property and rent it out for a period, then decide to renovate, this is a different matter and would allow you to claim 100% of the residual asset value of items that have been thrown away due to obsolescence.

Let’s look at a small case study to examine some potential depreciation deductions from scrapping and a renovation.

A property investor purchases an older style property with some depreciation value left on the plant and equipment items. The property is rented out for two full years, and at the end of the third year, the kitchen is renovated with the cook top, dishwasher, oven, range hood and vinyl floor being removed.

Let’s assume the investors utilise the diminishing value method, are able to claim full financial years and just focus on the kitchen area.

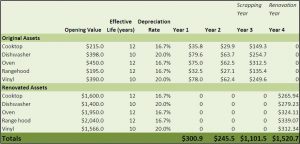

You can see in the figure below that in the first two years, the property is returning $300 in the first year and then $245 in the second (you can see the effect of the diminishing method here).

Then at the end of the 3rd year, they decide that the kitchen assets have reached the end of their useful life and are ready for the bin. They are able to claim 100% of the value left for each asset. So for the cooktop it is the opening value of $215 minus $35.8 minus $29.9 = $149.3.

Compare the total for the first two years against the scrapping year and you can clearly see a large benefit in scrapping the assets, even when we’re looking at an old kitchen.

In year four, you can now see that there is no claim for the original assets as they no longer exist in the property. As for the renovated assets, they were installed ready for use on day one of the fourth year and depreciate based on their purchased value and depreciation rates. It’s interesting to note that the scrapping year has almost as many deductions as the first year on the brand new assets.

It’s important to obtain a tax depreciation schedule to help identify the value of the original assets and ensure that the depreciation claim is handled correctly. If you’re about to undertake a renovation, the best practice is to have an inspection undertaken prior to the works being carried out. If you’ve already disposed of the assets, a Quantity Surveyor can work from prior photographic evidence.

Renovating for profit can be a great way to increase the value of a property. It is certainly a great way to achieve additional tax depreciation deductions.

Hopefully this provides you with a concise overview of the process of scrapping depreciable assets that have reached obsolescence. For more information, please don’t hesitate to contact me.