What sort of tax deductions will a swimming pool give you?

Swimming pools and depreciation – What sort of tax deductions will a swimming pool give you?

It’s not unheard of for an investment property to have a swimming pool, certainly a shared one as part of the common areas of a larger unit development is very common. However, residential houses with swimming pools aren’t terribly common due to the costs of maintenance, compliance issues with fences and the like. I’ve never heard of an investor installing one for a tenant, but certainly, plenty of investors buy properties with one already in place. This is especially the case when the investor has a view to occupying the property themselves down the track.

So, if you are looking to purchase or have purchased an investment property with a swimming pool, what sort of deductions are you looking at?

You’re going to hate me, (presumably we’ve not already met for you to hold that opinion already), but there are a lot of variables here. Let’s look at the most obvious one, that being the breakup between the plant and equipment component and the structure component.

Within a swimming pool, there are only a few items that are listed as plant and equipment within the legislation.

These are mostly, but not limited to;

• Swimming Pool Chlorinators & Filtration Assets

• Heaters (electric, gas or solar)

• Cleaners

Yes, there’s also swimming pool covers and potential spa pumps and the like but it’s mostly going to be the filter and any automated cleaner devices.

The good news is that these items depreciate at much faster rates to the pool itself, anywhere from 10% to 28.6% under the diminishing value method in general.

The bad news is that since 2017, to claim these plant items you either need to buy the property as brand new or add these assets to the rental property yourself. Consequently, most investors aren’t likely to be able to claim the assets at all. Still, for the sake of argument, we’ll analyse the deductions on them anyway.

The good news is that MOST of the value of a pool is in the division 43 capital improvement category. So, if it’s a concrete pool, it’s all the concreting as well as the pool fencing, tiling etc. It’s the highest component of total value, but we’re talking a flat percentage of 2.5% per annum for 40 years from the date of installation. What’s positive though is that you don’t have to build the pool yourself or buy it in a brand-new property. The changes to plant items in 2017 don’t impact structural deductions so it’s fine to claim if it was installed after the cut-off date for division 43 allowances.

Enough legislation I’m sure you’re thinking, show me the deductions!

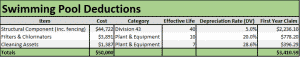

Of course, this is contingent on the value of the pool, but I’ve gone with a pretty standard concrete construction here at $50,000 in total, with some limited plant items. As you can see though, over $3,400 worth of deductions within the first full year alone if you purchase a new property with a pool or install it into your rental property yourself, which is nothing to sneeze at. If this property was one year old at the time of purchase, the deductions would drop to $2,236 as per the division 43 deductions only.

I hope that provides a guide as to the potential deductions, but as always, the decision to install one or buy a property with one in place should not be made on the deductions alone. There are several key considerations both positive and negative when you own a property with a pool. Still, if you do put one in, drinks at yours this summer?